Chromatography Market Profile

During the last several years, the GC market has experienced strong growth in part because of new product introductions, growth in the petroleum sector, and increased opportunities in various geographies. To shed light on and determine the many realities and trends of the current GC instruments market, Strategic Directions International conducted a global survey of gas chromatography (GC and GC-MS) users. The survey was designed for individuals who are currently using a wide array of GC instruments and consumables, including aftermarket software, components, and accessories. The data were collected over the phone and by an internet-based survey. When necessary, the internet survey was followed up with direct telephone interviews of the appropriate respondents to further clarify answers.

During the last several years, the GC market has experienced strong growth in part because of new product introductions, growth in the petroleum sector, and increased opportunities in various geographies. To shed light on and determine the many realities and trends of the current GC instruments market, Strategic Directions International conducted a global survey of gas chromatography (GC and GC–MS) users. The survey was designed for individuals who are currently using a wide array of GC instruments and consumables, including aftermarket software, components, and accessories. The data were collected over the phone and by an internet-based survey. When necessary, the internet survey was followed up with direct telephone interviews of the appropriate respondents to further clarify answers.

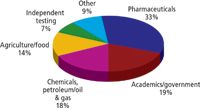

The end-user respondents were classified by many categories to provide a clear picture of their demographics. The largest industrial segments of the survey included pharmaceuticals, academia/government, and chemical sectors, which accounted for 33%, 19%, and 18% respectively. Survey participants were queried on their type of systems installed, system age, configuration, pricing, software, accessories, add-ons, service, and ratings of various parameters, among others.

2006 extraction technique product type.

The knowledgeable GC respondents were quite candid in their remarks and offered useful insights on areas for improvement. Many of them indicated that the GC market lacked intuitive analysis software. Other frequently mentioned areas for improvement included the system design issues like ease of system maintenance, column switching, and sample throughput.

Finally, the ratings portion of the survey offers an inside look at the respondents' attitudes regarding suppliers of GC and GC–MS products. Agilent received high ratings in the overall system build quality, while Varian and Thermo Fisher Scientific shined in the service and support department.

The foregoing data was extracted and adapted from SDi's Tactical Sales and Marketing: Gas Chromatography. For more information, contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, e-mail: cudiamat@strategic-directions.com

New Study Reviews Chromatography Methods for Flavonoid Analysis

April 21st 2025Flavonoids are widely used metabolites that carry out various functions in different industries, such as food and cosmetics. Detecting, separating, and quantifying them in fruit species can be a complicated process.

University of Rouen-Normandy Scientists Explore Eco-Friendly Sampling Approach for GC-HRMS

April 17th 2025Root exudates—substances secreted by living plant roots—are challenging to sample, as they are typically extracted using artificial devices and can vary widely in both quantity and composition across plant species.

Sorbonne Researchers Develop Miniaturized GC Detector for VOC Analysis

April 16th 2025A team of scientists from the Paris university developed and optimized MAVERIC, a miniaturized and autonomous gas chromatography (GC) system coupled to a nano-gravimetric detector (NGD) based on a NEMS (nano-electromechanical-system) resonator.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)