The Pharmaceutical Industry and the Separation Scientist: Perspectives, Trends, and Career Opportunities

This article provides an overview of the pharmaceutical industry for the separation scientist, including its historical, societal, and economic impacts, marketing landscape, therapeutics trends, and career opportunities in analytical chemistry.

This installment is the first of eight white papers on the pharmaceutical industry written for the separation scientist to be published between 2022 and 2024. The tentative topics planned are as follows:

1. The Pharmaceutical Industry and the Separation Scientist: Perspectives, Trends, and Career Opportunities

2. The Drug Discovery Process

3. The Drug Development Process

4. An Overview of Pharmaceutical Regulations

5. The Biopharmaceutical Industry and Characterization Techniques for Biotherapeutics

6. Analytical Development and Quality Control in Small Molecule Drug Development

7. Pharmaceutical Calculations and Equations for the Separation Scientist

8. Element of a Well-written Analytical Procedure for Regulated HPLC Testing.

This article series offers an insider’s view of the pharmaceutical industry and its drug development processes to those working within the industry and others who want a better understanding of this pivotal industry segment.

What is a Drug?

According to the Federal Food, Drug, and Cosmetic Act, section 201, a drug is a substance intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease for use as a component of a medicine but not a device. Several additional useful definitions and acronyms are:

- Drug Substance (DS) or Active Pharmaceutical Ingredient (API)— a small molecule, large biomolecule, single component, or a mixture with therapeutic properties.

- Drug Product (DP)—an actual dosage form or formulation administered to the patient containing a drug substance (tablets or capsules are common orally available drug products for small molecule drugs, whereas parenterals for intravenous or subcutaneous injections are typical for biologics).

- New Chemical Entity (NCE) or New Molecular Entity (NME)—a new drug candidate in development by a sponsor. Regulatory agencies must approve a new drug candidate before commercialization. It can be a small molecule drug or a biotherapeutic, such as a recombinant protein (monoclonal antibody [mAb]).

A Brief History of Medicine

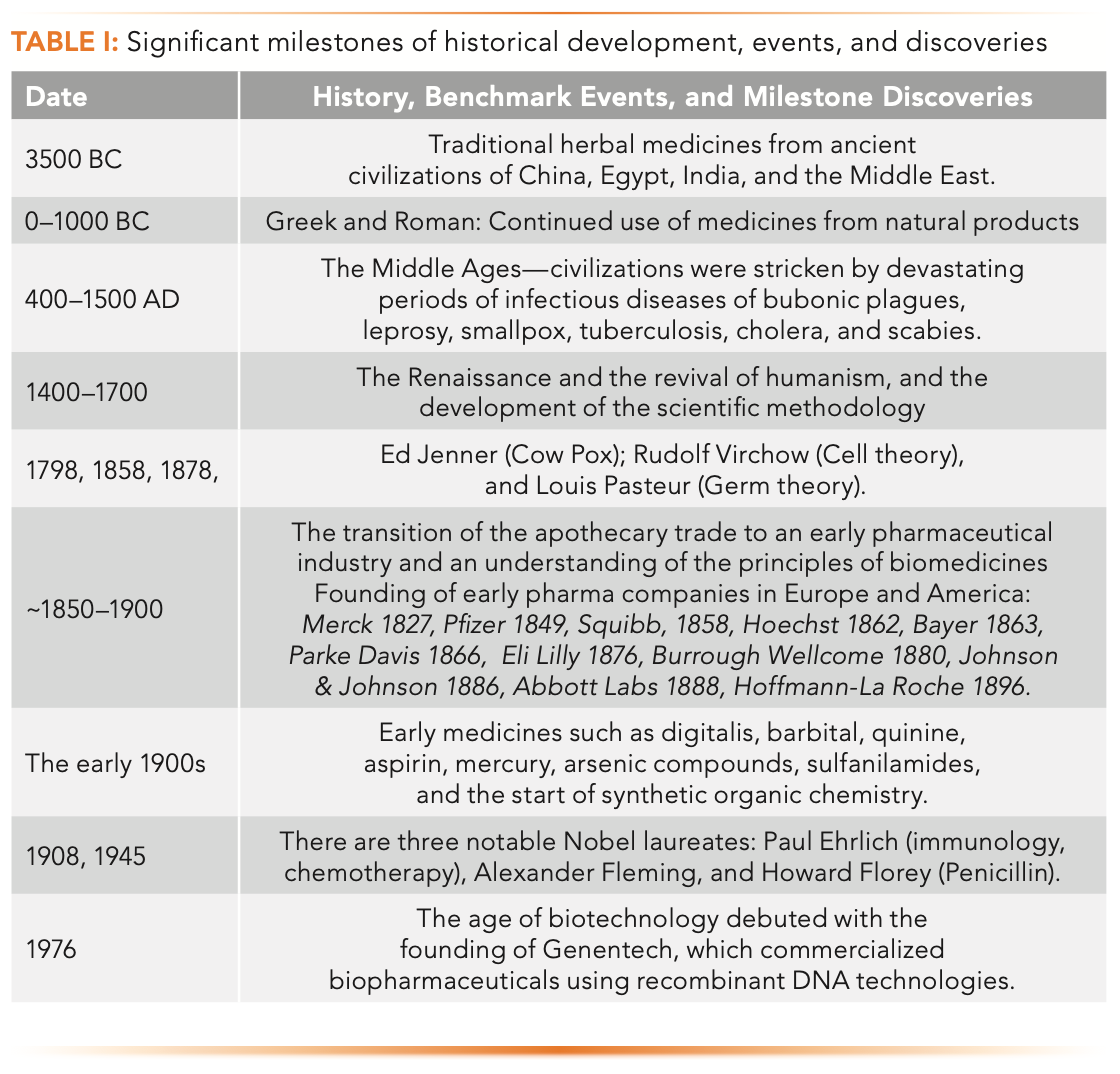

Table I highlights the significant historical developments, events, and discoveries that lead to the age of modern medicine.

Medicines for treating human diseases started approximately 5000 years ago in the ancient civilizations of China, India, Egypt, and the Middle East, using traditional medicines from herbs, animals, and minerals (1,2). This empirical approach to drug discovery using natural materials (extracts or purified) persisted through the Greek and Roman periods. During the middle ages from 400–1500 AD, civilizations were stricken periodically by devastating plagues (For example, the Bubonic Plague that killed millions in Europe) and infectious diseases, such as leprosy, smallpox, cholera, tuberculosis, flu, measles, and scabies. The Dark Ages led to the Renaissance in Europe with a revival of humanism and the emergence of the scientific method. Several events and theories that stood out in the 19th century toward a systematic understanding of diseases were the cowpox vaccination against smallpox by Ed Jenner in 1798, the cell theory by Rudolf Virchow in 1858, and the germ theory by Louis Pasteur in 1878.

The period of 1850–1900 marked a transition from smaller apothecaries to larger-scale manufacturers of phar- maceuticals founded in Europe and America. The early 1900s witnessed the increase of “medicines” (digitalis for epilepsy, quinine to treat malaria, aspirin for pain, mercury, and arsenic compounds). The discovery of sulfa drugs or sulfanilamides as effective antimicrobials in the 1930s was particularly noteworthy becwwause it ushered in an age of synthetic organic chemistry. Three influential Nobel laureates in medicines were Paul Ehrlich in 1908, and Alexander Fleming and Howard Florey for the discovery and process development of penicillin. The founding of Genentech by Herb Boyer and Rob Swanson in 1976 was recognized as the beginning of biotechnology. Genentech commercialized several early biopharmaceuticals (human growth hormone, human insulin, tissue plasminogen activase (t-Pa)), and later, a hugely successful mAb biotherapeutic (Herceptin) in 1998 (1,3–5).

Evolution of Drug Development Approaches

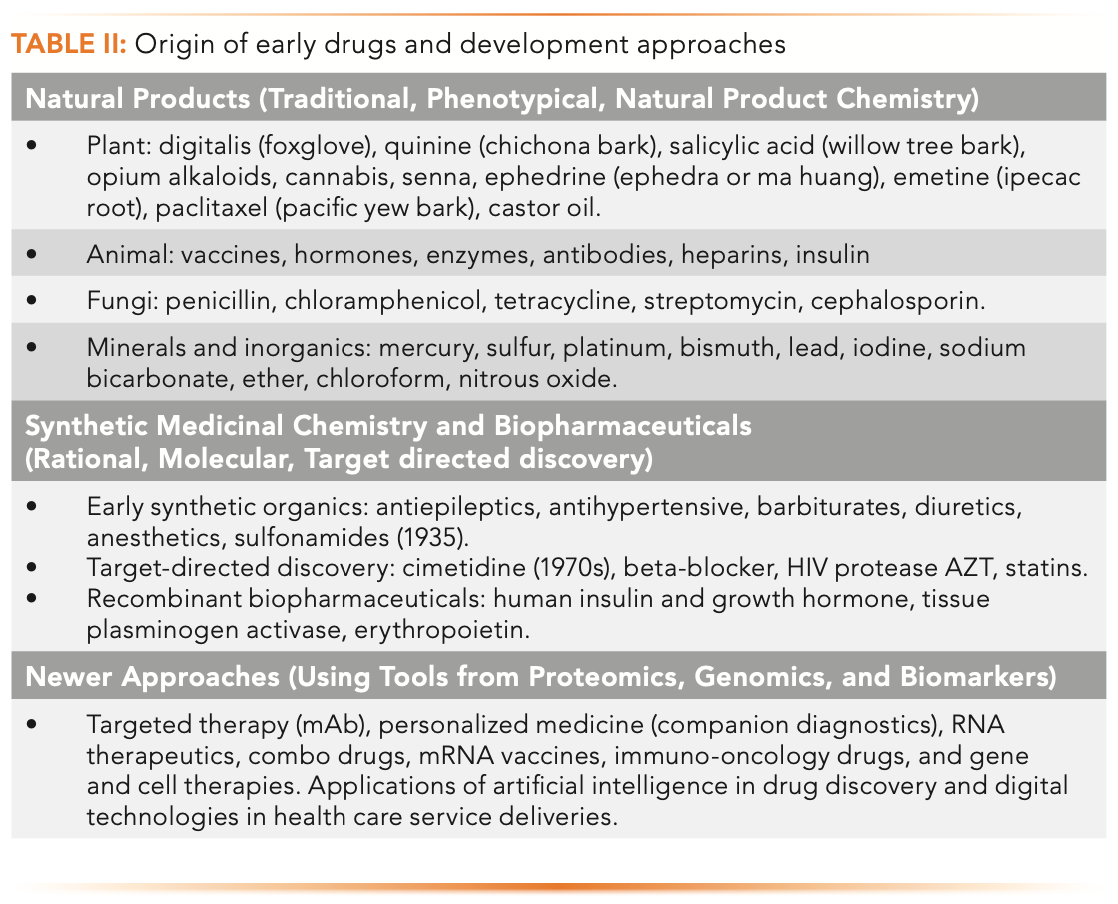

Table II lists examples of early drugs from natural resources by serendipitous discovery through identifying the active ingredient from plants, animals, fungi, minerals, and inorganic materials. Next, the era of synthetic medicinal chemistry arrived, which evolved into a rational target-directed discovery approach with a deeper understanding of the molecular biology of diseases. The discovery of DNA and its link to protein synthesis led to the birth of biotechnology and the biopharmaceutical industry in the 1970s. Today, there are many innovative approaches to drug development using tools from genomics and proteomics guided by disease biomarkers, in addition to new drug modalities such as mAbs, antibody–drug conjugates (ADC), RNA therapeutics, combination drugs, mRNA vaccines, immuno-oncology, and gene–cell therapies (1,6).

Perspectives and Trends

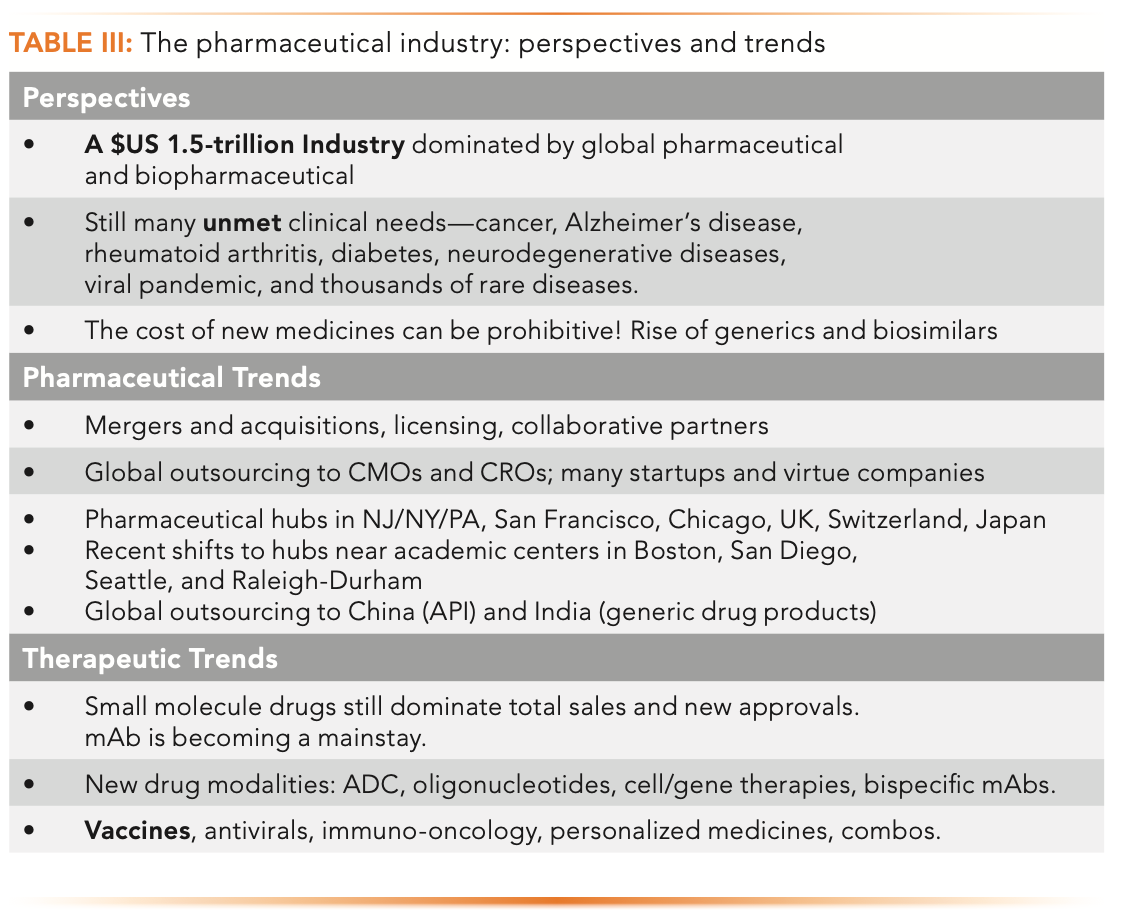

Table III provides an overview of trends of the pharmaceutical industry perspectives of the modern pharmaceutical industry and its impact on public health and the economy. Furthermore, the list captures salient trends of the pharmaceutical industry and therapeutic approaches ranging from small molecule organics to biologics (1,6–7).

Perspectives

Today, the pharmaceutical segment is a $1.5-trillion industry dominated by a dozen or more global companies pursuing innovative drugs for serious diseases such as cancer, Alzheimer’s disease, rheumatoid arthritis, diabetes, neurodegenerative diseases, viral infections, and others with unmet clinical needs. One serious public complaint is the prohibitive prices of medicines, often costing hundreds of thousands of dollars for each regimen. The industry argues that high price is justifiable by the expense of new drug development, in the realm of $1–2 billion for each new drug, and the short period for cost recovery before patent expiration. For small molecule drugs, the Hatch and Waxman Act of 1984 laid the legal foundation for the generic industry, which offered equivalent products at a fraction of the cost of the originals. The Biologics Price Competition and Innovation Act passed in 2010 allowed a similar, though less cost-saving pathway for biosimilars because clinical trials were still required to demonstrate the safety and efficacy of these imitating biologics (1,6).

The pharmaceutical industry is a major employer of analytical chemists, particularly separation scientists. The career opportunity aspects are discussed in a later section (8).

Pharmaceutical Business Trends

In addition to new drug development using internal resources, there have been major pharmaceutical attempts to grow sales and product portfolios through mergers and acquisitions, licensing NCEs, and collaborative partners. The industry spends inordinate sums of money on global outsourcing in drug development using contract manufacturing organizations (CMOs) and contract research organizations (CROs). This enormous profit potential attracted many new pharmaceutical startups that were often funded by venture capitals. Most startups have limited internal developmental resources. Many were virtue companies without laboratory facilities or personnel; these startups relied on contract development and manufacturing organizations (CDMOs) to take NCEs from concept to early-phase clinical trials (6). A promising phase 1 or phase 2 candidate can reap offers worth billions of dollars when the company is acquired by an established pharmaceutical brand. A case in point was the acquisition of Pharmasset, a startup in New Jersey by Gilead Sciences, for $11 billion in 2011 for its phase-2 drug candidates for chronic hepatitis C virus infection, which led to a highly successful drug product launch of “Solvaldi (sofosbuvir)” in 2013. Solvaldi set a sales record of $10.4B in the first year, triggering interest from Wall Street in small molecule drugs.

Early pharmaceutical companies were primarily based in Europe (Germany, Switzerland, France, and the United Kingdom) and the United States east coast or midwest (New York, New Jersey, Pennsylvania, Connecticut, Chicago, and Michigan). The rise of biotechnology in San Francisco by Genentech and Cetus quickly established the Bay Area as a major biopharmaceutical hub (7). There has been a locational shift toward pharmaceutical hubs near academic centers, such as Boston, San Diego, Seattle, and Raleigh-Durham, in recent years. China and India have been the top countries for global outsourcing—China for API and raw material production and India for drug products (generics). China is also rapidly emerging as a significant player in innovative drug development and out-licensing, particularly in biopharmaceuticals (6,8).

Therapeutic Trends

Although biotherapeutics are attracting the most public attention because mAbs is becoming a mainstay for oncology and immunology indications, approximately three-quarters of the global sales and new drug approvals are still dominated by small molecule drugs. An exciting recent trend is the development of new drug modalities such as antibody–drug conjugates (ADC), oligonucleotides, messenger ribonucleic acid (mRNA) vaccines, cell and gene therapies, and newer therapeutic concepts such as immuno-oncology and personalized medicines using companion diagnostics (1,6).

The Marketing Landscape

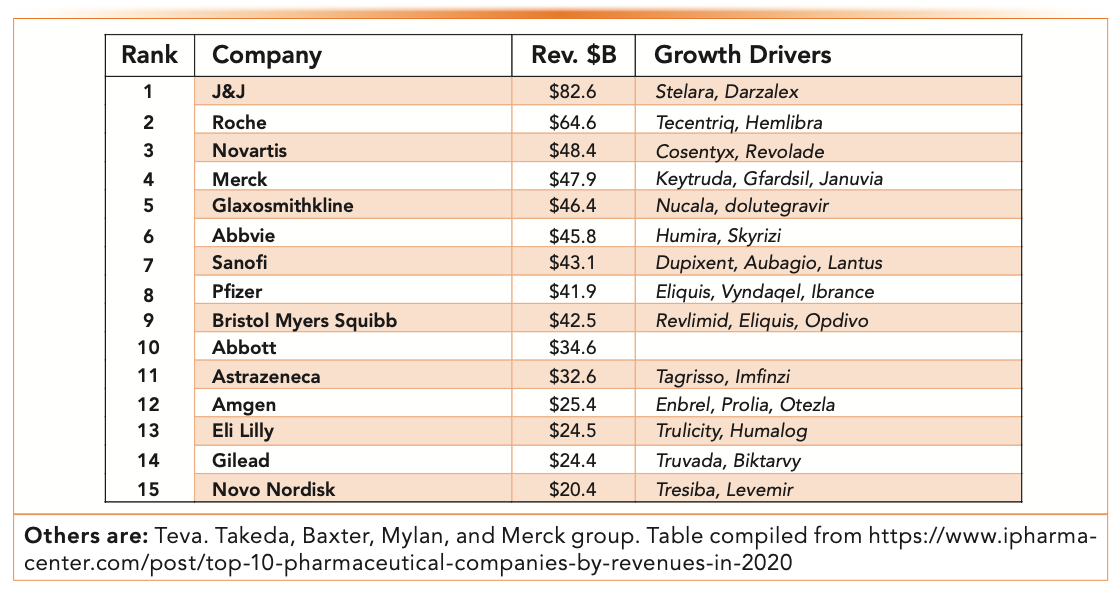

Figure 1 shows the top 20 pharmaceutical companies by revenues in 2020 and some of their top product sales drivers. Note that Figure 1 shows the sales of $83 billion from the leader Johnson & Johnson (J&J), which includes sales of medical devices and consumer products. Roche’s (Genentech) sales of $65 billion include revenues from clinical diagnostics, followed by others with annual revenues in the range of $20–40B (9).

FIGURE 1: Top 15 pharmaceutical companies by total revenue in 2020 (in US$ billions).

Figure 2 lists the pharmaceutical-only revenues for 2021 and shows a substantial change in the rankings. Pfizer became the sales leader in 2021 because of the enormous success of its mRNA Covid vaccine with BioNTech (10).

FIGURE 2: Top 10 pharmaceutical companies by pharmaceutical revenues in 2021 (in US$ billions). Figure from reference 10.

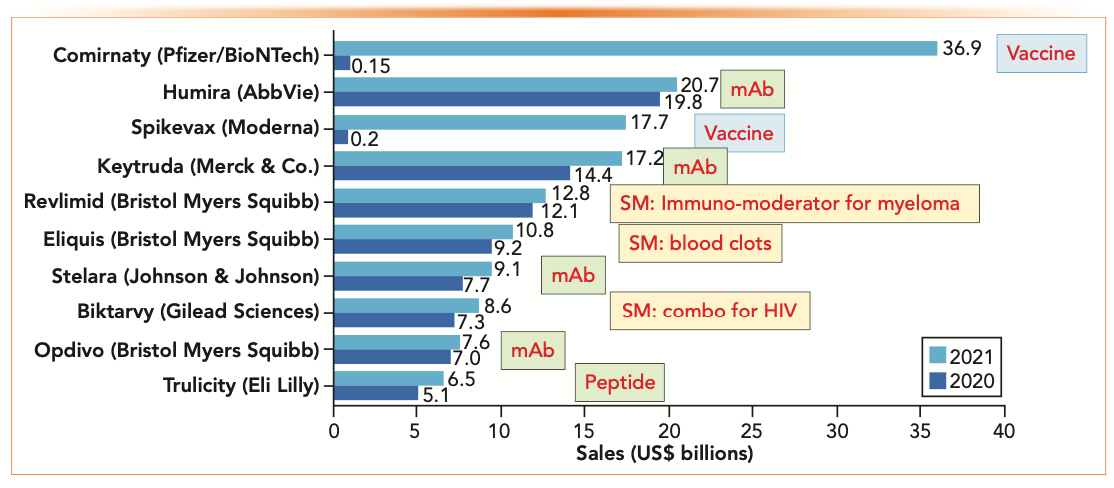

Figure 3 shows the top 10 drug products by global sales in 2021, showing the #1 and #3 products going to mRNA Covid vaccines from Pfizer/BioNTech and Moderna, displacing the perennial sales leader Abbvie’s Humira for rheumatoid arthritis (10). The breakdown of product categories of these top 10 products were as follows: seven biologics (two vaccines, four mAbs, and one peptide) and three small molecule drugs (an immuno-moderator, a combo for human immunodeficiency virus [HIV], and one for blood clots).

FIGURE 3: Top 10 drug products by global sales in 2021 (in US$ billions). Figure from Reference 10.

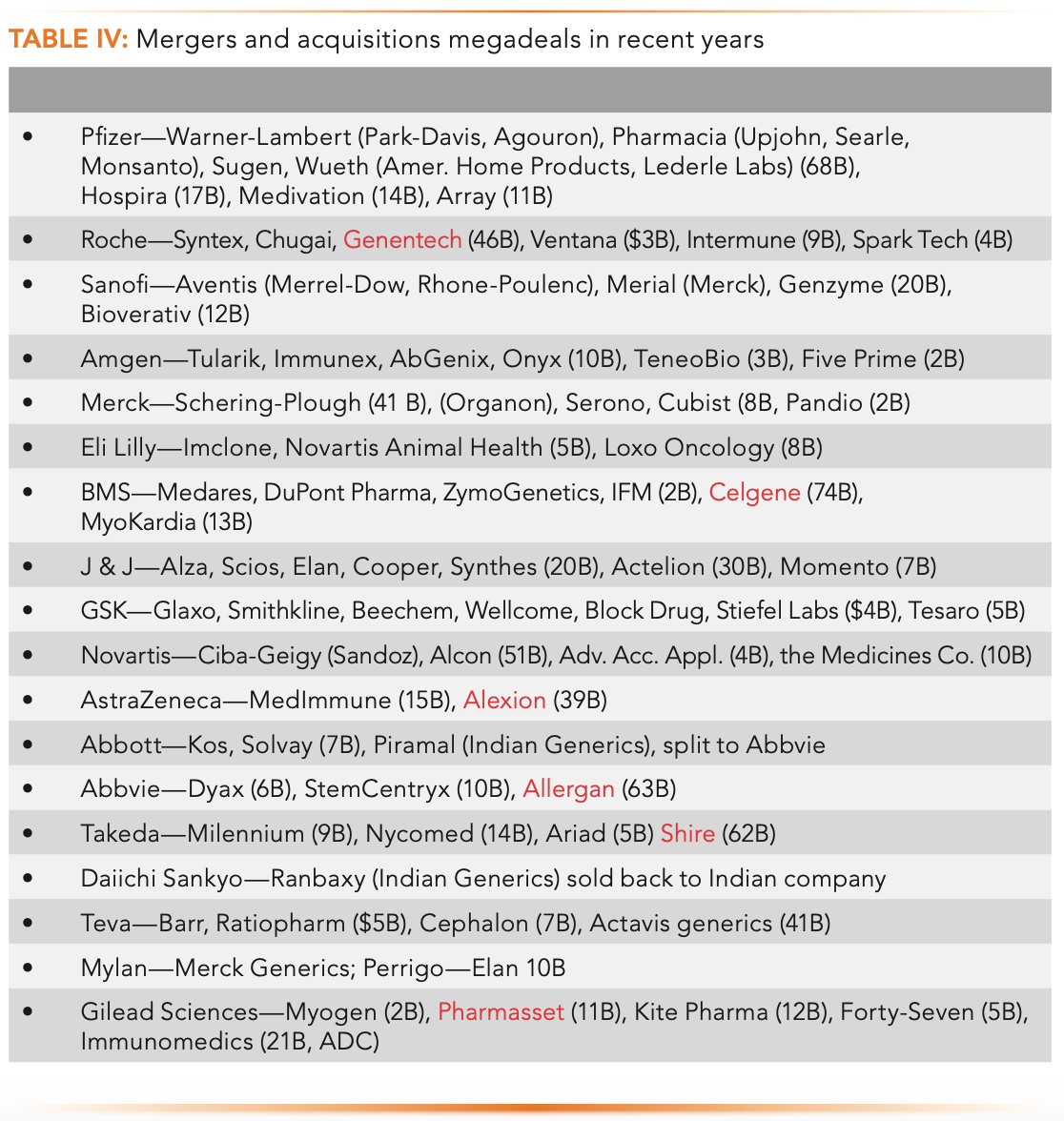

Table IV lists prominent pharmaceutical mergers and acquisitions in recent years. Data were collected over many years, mainly from Chemical & Engineering News from the American Chemical Society.

Table IV also shows that Pfizer is the most prolific acquiring company involving many megadeals by acquiring Warner-Lambert, Park-Davis, Pharmacia, Upjohn, Searle, Wyeth, and Hospira (6). Roche acquired 60% of Genentech in 1990 with just $2B and purchased the entire company in 2009 with a megadeal of $47B. For years, Roche (Genentech) was the leader in oncology drugs but ceded this title to Bristol Myers Squibb (BMS), which acquired Celgene for $74B. Three recent megadeals were the acquisitions of Alexion by AstraZeneca for $39B, Allergan by AbbVie for $63B, and Shire by Takeda for $62B.

Pharmaceutical Career Opportunities for Analytical Chemists

In this section, the career opportunities of analytical chemists, particularly separation scientists, are explored. The job functions within the pharmaceutical industry in analytical development and quality control are described together with job requirements and the pros and cons of the scientist and laboratory jobs in this industry (8).

Drug development offers the largest employment opportunities for analytical chemists, particularly for those skilled in high-performance LC (HPLC) and mass spectrometry (MS). The departments that hire analytical scientists are analytical development, quality control, bioanalysis, and drug metabolism and pharmacokinetics (DMPK), in addition to management opportunities in quality assurance, regulatory, and project, laboratory, contract manufacturing organization (CMO), or supply chain management.

Other job functions are those in drug discovery support for purification and high-throughput screening and characterization, analytical support for process and formulation laboratories, and specialists in assay automation, nuclear magnetic resonance (NMR), and solid-state characterization. Some pharmaceutical research groups may offer limited opportunities in proteomics, clinical diagnostics, assay development, and discovery (validation) of clinical biomarkers.

Figure 3 is a pictorial depiction of the various groups in the Technical Development Department of a major pharmaceutical organization, often called the Chemistry, Manufacturing, and Control (CMC) or Pharmaceutical Science Organization. The significant roles of analytical chemists are highlighted in red, including analytical development, quality control, and bioanalysis and DMPK (11,12).

Pros and Cons of Pharmaceutical Scientist Positions

The choice to work in a particular industry is a highly personal matter and is often driven by intent, idealism, job availability, or even serendipity (8). Some typical pros and cons of of the pharmaceutical industry for working as an analytical chemist, and the preferred experience for getting hired in the pharmaceutical industry, are listed below.

Pros

There are many advantages for scientists working the pharmaceutical companies, such as research opportunities for the betterment of public health and excellent career advancements. The industry also offers higher pay and competitive benefits, including bonuses and stock options for well-established companies. Nevertheless, the higher cost of living in major-city locations offsets many of these benefits.

Cons

The cons are higher job-related stress levels to support multiple fast-moving development projects with tight timelines and the need to adhere to regulations and internal processes for those in quality control or regulatory functions. Most scientist positions require several years of related industry experience and an advanced degree with the requisite technical and communication skills. Other desirable experiences include knowledge of Good Manufacturing Practice (GMP) and CMC processes, familiarity with overseeing CMOs, CROs, or both, and a record of regulatory filings.

Summary

This article provided an overview of the pharmaceutical industry for the separation scientist, including a brief description of its history, business landscape, drug development approaches, modern therapeutic trends, and career opportunities.

Disclaimer

This paper provided a brief overview of the pharmaceutical industry and its significant business and product trends. The information presented here stems from books, journal articles, and internet resources collected for my short course in drug development and often reflects my opinions and interpretations.

Acknowledgments

The author thanks the following reviewers who provided timely comments on the technical content and clarity of the manuscript: He Meng from Sanofi, Oscar Liu from Silver Spring Scientific LLC, Tao Jiang from Mallinckrodt, and Alice Krumenaker from TW Metals LLC.

References

(1) R.G. Hill and H.P. Rang, Eds., Drug Discovery and Development: Technology in Transition (Churchill Livingston, London, United Kingdom, 2nd ed., 2012).

(2) R. Ng, Drugs: From Discovery to Approval (Wiley-Blackwell, Hoboken, NJ, 3rd ed., 2015).

(3) K.M.G. Taylor and M.E. Aulton, Eds., Aulton’s Pharmaceutics: The Design and Manufacture of Medicines (Elsevier, Amsterdam, The Netherlands, 6th ed., 2021).

(4) J.J. Campbell, Understanding Pharma: The Professional’s Guide To How Pharmaceutical And Biotech Companies Really Work (Syneos Health, Morrisville, NC, 3rd ed., 2018).

(5) N.K. Pandit, Introduction to the Pharmaceutical Sciences (Lippincott, Williams and Wilkins, Philadelphia, PA, 2006).

(6) M.W. Dong, “Drug Discovery and Development Processes,” short course presented at Pittcon, Philadelphia, PA, 2019.

(7) S.S. Hughes, Genentech: The Beginnings of Biotech (University of Chicago Press, Chicago, IL, 2013).

(8) M.W. Dong, “Careers in Pharmaceutical Industry for Analytical Chemists: A Personal Journey,” talk presented at the ACS National Meeting (Atlanta, GA, 2021)

(9) iPharmaCenter, Top 20 Pharmaceutical Companies by Revenues in 2020. https://www.ipharmacenter.com/post/top-10-pharmaceutical-companies-by-revenues-in-2020 (accessed May 2022).

(10) L. Urquhart, Nat. Rev. Drug Discov. 20, 253 (2022).

(11) M.W. Dong, LCGC North Am. 33(10), 764–775 (2015).

(12) M.W. Dong, HPLC and UHPLC for Practicing Scientists (Wiley, Hoboken, NJ, 2nd ed., 2019), Chapter 9.

ABOUT THE AUTHOR

Michael W. Dong is a principal of MWD Consulting, which provides training and consulting services in HPLC and UHPLC, method improvement, pharmaceutical analysis, and drug quality. He was formerly a Senior Scientist at Genentech, a Research Fellow at Purdue Pharma, and a Senior Staff Scientist at Applied Biosystems/PerkinElmer. He holds a PhD in Analytical Chemistry from City University of New York. He has more than 130 publications and a best-selling book in chromatography. He is an editorial advisory board member of LCGC North America and the Chinese American Chromatography Association. Direct correspondence to: LCGCedit@mmhgroup.com.

Study Explores Thin-Film Extraction of Biogenic Amines via HPLC-MS/MS

March 27th 2025Scientists from Tabriz University and the University of Tabriz explored cellulose acetate-UiO-66-COOH as an affordable coating sorbent for thin film extraction of biogenic amines from cheese and alcohol-free beverages using HPLC-MS/MS.

Multi-Step Preparative LC–MS Workflow for Peptide Purification

March 21st 2025This article introduces a multi-step preparative purification workflow for synthetic peptides using liquid chromatography–mass spectrometry (LC–MS). The process involves optimizing separation conditions, scaling-up, fractionating, and confirming purity and recovery, using a single LC–MS system. High purity and recovery rates for synthetic peptides such as parathormone (PTH) are achieved. The method allows efficient purification and accurate confirmation of peptide synthesis and is suitable for handling complex preparative purification tasks.