Ultrahigh-Pressure LC–MS Driving Proteomics and Metabolomics Research

LCGC North America

Over the past 20 years, the use of LC– MS instruments has become increasingly important to many researchers. The performance of LC–MS instruments has continued to advance, reaching higher levels of sensitivity and increased resolution.

Over the past 20 years, the use of LC– MS instruments has become increasingly important to many researchers. The performance of LC–MS instruments has continued to advance, reaching higher levels of sensitivity and increased resolution.

The overall market for these advanced LC–MS instruments can be somewhat broadly categorized as high-end LC–MS and ultrahigh-pressure LC–MS (UHPLC– MS), including high-end triple quadrupole, LC-TOF, quadrupole-time-of-flight (QTOF), orbital trap, FT-ICR, or magnetic resonance mass spectrometry (MRMS) instruments. The workhorse of many laboratories has traditionally been leveraging high-end triple quadrupole LC–MS for quantitation and QTOFs for sensitivity. For targeted applications, users still gravitate to triple quadrupole LC–MS. For untargeted research applications, scientists have more options available in addition to QTOFs, including UHPLC–MS systems like orbital trap and MRMS technologies, as well as top-of-the-line QTOF instruments that are typically equipped with ion mobility spectrometry (IMS) to increase selectivity.

UHPLC–MS systems are being used for top-down proteomics as well as deep metabolic profiling of complex mixtures to complement the workhorse instrument setup of UHPLC-QTOF–MS. Top-down proteomics has become an increasingly popular strategy to analyze intact proteins. Throughput has been challenging in these applications, and many researchers have opted to furnish their laboratories with several LC–MS units to increase their laboratories’ productivity.

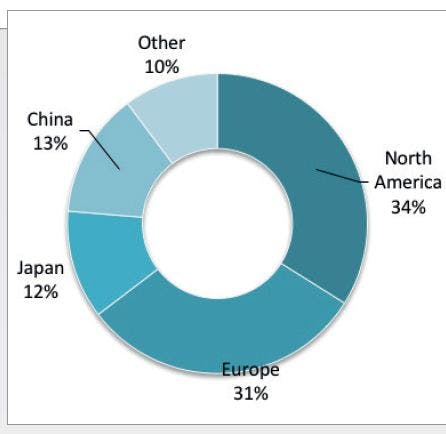

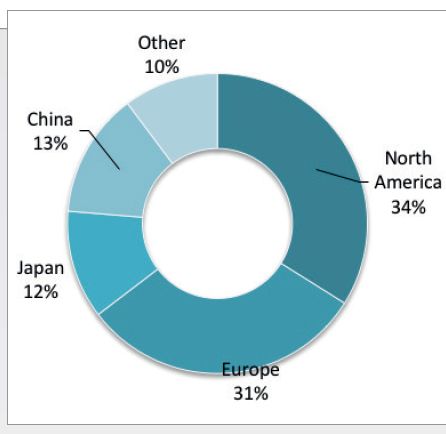

The total demand for high performance LC–MS instrumentation was measured at $1.6 billion in 2017 driven by continued investments in proteomic and metabolomics research. North America and Europe account for three quarters of the market fueled by demand from government and academia. Demand from biopharmaceutical research and clinical research organizations is expected to outpace the market. China is also experiencing robust growth for UHPLC–MS instruments.

The UHPLC–MS market is led by Bruker and Thermo Fisher Scientific, while Sciex and Waters lead the high-end segment. Bruker is the supplier of MRMS and Thermo Fisher is the supplier of orbital trap instruments. Sciex is the leading supplier of triple quadrupole LC–MS, while Waters has the leading position of the QTOF market.

Demand by region for ultrahigh pressure LC–MS in 2017.

Market size and growth estimates were adopted from TDA’s Industry Data, a database of technology market profiles and benchmarks, as well as the 2018 Instrument Industry Outlook report from independent market research firm Top-Down Analytics. For more information, contact Glenn Cudiamat, general manager, at (888) 953-5655 or glenn.cudiamat@tdaresearch.com. Glenn is a market research expert who has been covering the analytical instrumentation industry for more than two decades.

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.