Mass Spectrometry — Sustaining Growth in a Challenging World

Special Issues

A focused outlook on how laboratory mass spectrometry techniques will fare this year compared to 2012.

This article provides a focused outlook on how laboratory mass spectrometry (MS) techniques will fare this year compared to 2012. We look specifically at triple-quadrupole MS, Fourier transform MS, quadrupole time-of-flight MS, ion-trap MS, inductively coupled plasma–MS, matrix-assisted laser desorption–ionization time-of-flight MS, and magnetic sector instruments as well as the clinical market and government demand. Finally, we examine the competitive landscape in these areas.

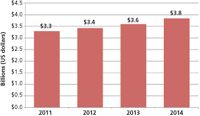

The worldwide market for laboratory mass spectrometry (MS) techniques in 2012 was worth in excess of $3.4 billion, which was up more than 4% versus 2011, despite increasing weakness in many areas toward the end of the year. Figure 1 provides estimated total revenues for the market from 2011 through 2014, which will average better than 5% annual growth. Triple-quadrupole instruments have become some of the most significant drivers of the market. High-end techniques including quadrupole time of flight (QTOF) and Fourier transform mass spectrometry (FT–MS) are also likely to be major contributors to the growth of the overall MS market, but are more sensitive to constrained capital spending because of their high price. Demand for ion-trap and magnetic sector technologies are among the most mature portions of the market, while matrix-assisted laser desorption–ionization time-of-flight mass spectrometry (MALDI-TOF-MS) and inductively coupled plasma–mass spectrometry (ICP-MS) appear to have strong future potentials remaining. The clinical analysis sector is now becoming one of the strongest industrial drivers of demand for MS, but government and related demand will clearly present a challenge to the market in the short term. Despite the growth of the overall market, the barriers to entry result in a significant concentration of vendor share among a handful of companies.

Figure 1: Worldwide laboratory MS demand for 2011â2014.

Triple-Quadrupole Technologies

Triple-quadrupole MS, often referred to as tandem MS, is currently the hottest technology in the MS market. Triple-quadrupole gas chromatography–mass spectrometry (GC–MS), liquid chromatography–mass spectrometry (LC–MS), and ICP-MS grew at a double-digit pace in 2012, and now account for more than a quarter of total MS demand. Triple-quadrupole instruments have proven to be extremely good for quantitation of very low trace levels of compounds of interest, even in very complex samples. This has made such techniques extremely popular in a wide range of industries and applications, such as analyzing low-level contaminants in environmental water samples, detecting trace levels of pesticides and other health threats in foods, and quantitating key biological markers in the clinical analysis sector. The pace of new model introductions has been extremely high over the past three years, with each new system often claiming to offer an order of magnitude improvement in sensitivity or better, as well as other major performance gains. All four current competitors in the triple-quadrupole GC–MS market have introduced new models during this period, including segment leader Agilent, and recent market entrant Shimadzu. In the triple-quadrupole LC–MS area, there have been more than a dozen new instrument introductions since 2010, including the entrance of both Bruker and Shimadzu to the area. In 2012, Agilent introduced the first ever commercial triple-quadrupole ICP-MS system, which leverages the low-level quantitative capabilities of triple-quadrupole MS for a technique that is already established for trace-analysis applications. Despite a somewhat challenging environment in 2013, triple-quadrupole–based MS technologies should still average high single-digit growth.

FT–MS Versus QTOF

At the high end of the mass spectrometry market in terms of both cost and performance are QTOF and FT–MS instruments. Although the two categories are drastically different in how they work, QTOF and orbital trap–based FT–MS instruments both offer very high resolution and compete vigorously against one another. Thermo Scientific is the one and only supplier of the orbital trap–based mass spectrometers (Orbitrap) that it targets to the same customers served by QTOF suppliers, which primarily include AB Sciex, Agilent, Bruker, and Waters. Bruker is the only other major supplier of FT–MS instruments now that Agilent has discontinued the IonSpec product line that came with the Varian acquisition. However, Bruker's models are generally a level above Thermo's orbital trap–based models in both price and performance, and do not generally compete with QTOF instruments. It is not clear which technology, if either, will win out in the long term among the advanced life science researchers that are the primary users of these instruments. All of the major competitors in this area of the market have continued to develop and introduce new models with significant performance improvements year after year, which has helped to drive what has been among the strongest growing segments of the MS market. However, 2012 was a weaker year, as it was for most other analytical technologies, although the impact was significantly stronger in the QTOF market than for FT–MS. Looming government budget cuts and great uncertainty in government spending had a large part to do with it, causing many research institutions to delay such large capital expenditures. Such impacts are likely to continue well into 2013, although demand should pick back up to a double-digit pace in 2014 because these instruments are now leading the way in many life science sectors, as well as becoming more common in applied markets.

Ion-Trap Mass Spectrometry

One class of MS that appears to be waning is ion-trap-based instruments. Traditionally, ion-trap instruments, including both LC–MS and GC–MS, were better at qualitative analyses and quadrupole systems were better for quantitative analyses. In addition, ion-trap systems have traditionally been less expensive. However, the majority of applications for which GC–MS is used tend to be more quantitative than qualitative, and the rise of triple-quadrupole GC–MS and GC–TOF-MS has eaten away at ion-trap GC–MS demand as well, resulting in the potential for fading demand in some applications. Thermo Scientific and the former Varian product line that is now owned by Agilent have long been the only two major suppliers of ion-trap GC–MS systems. In the LC–MS market, the development of various technologies, including QTOF and FT–MS, has negatively affected demand for conventional ion-trap LC–MS. However, the development of novel ion-trap designs, and the incorporation of electron-capture dissociation (ECD) has helped the technique remain relevant in certain applications and, therefore, demand is still expected to see modest growth in the foreseeable future, although not at the pace of other LC–MS technologies. Only Thermo Scientific and Bruker, which offer advanced ion-trap designs, remain significant vendors, with Hitachi, and more recently Agilent, bowing out of the area. The low cost and simplicity of ion-trap MS has been attractive to vendors of portable mass spectrometers, variations of which can be found in newer models. However, uncertain government demand will make for weak demand for the portable MS market in the near term.

ICP-MS and Secondary Ion Mass Spectrometry

Demand for ICP-MS has steadily grown to more than $360 million since the first commercial introduction 20 years ago, and is on course to rival the size of total demand for atomic absorption (AA) and inductively coupled plasma–optical emission spectrometry (ICP-OES) in a few more years. ICP-MS offers higher throughput and much lower levels of detection relative to these other elemental analysis techniques. Much of the demand for ICP-MS is related to water analysis in the environmental and the semiconductor and electronics industry, while secondary ion mass spectrometry (SIMS) is also common in semiconductor labs. Combined, ICP-MS and SIMS account for 14% of the total laboratory MS market, as shown in Figure 2. Demand from the environmental sector continues to be driven by regulatory requirements that have been set tighter and tighter, and therefore necessitate the use of ICP-MS, as other techniques do not offer the same level of sensitivity. Microchips and other electronics are incredibly sensitive to trace metal contamination, which can come from process water and chemicals used in the manufacturing process. ICP-MS has become the standard technique for monitoring the quality of such fluids. Demand for capital equipment in the semiconductor and electronics industry is notoriously cyclical, and the early part of 2013 marks a point of decline for demand, which will limit overall growth in ICP-MS demand to the low single-digits. However, the prospect for stronger overall growth in ICP-MS demand is much better in 2014 and beyond. SIMS demand, on the other hand, is even more reliant on the semiconductor and electronics industry, and will see a small decline in 2013 before rebounding.

Figure 2: Worldwide mass spectrometry demand by technique for 2012.

MALDI-TOF

MALDI-TOF mass spectrometry includes several significantly different variations, such as simple low-cost linear systems, reflectron TOF systems, and tandem TOF (that is, TOF-TOF) instruments. There are also a number of ion-trap time-of-flight (IT-TOF) and QTOF variants on the market, most of which are based on existing LC–MS platforms. Demand for the various configurations of MALDI-TOF instruments has been somewhat variable over the past decade, leading to inconsistent year-to-year growth. MALDI-TOF-TOF systems, which are the highest performing, most capable, and most expensive of the variants are now seeing high single-digit growth, mostly because of demand from biomarker research laboratories. However, it is the lower-cost linear MALDI-TOF segment that is really driving the entire MALDI-TOF market. Linear models, which in some cases cost less than $100,000, offer a relatively simple alternative to LC–MS, and are now commonly used as the basis for a number of clinical diagnostics solutions, as well as for rapid screening in other industries.

Magnetic Sector

Magnetic sector MS has become somewhat of a niche technique, with most of the demand centered around geological research, environmental testing, and sports doping applications. It is a very mature market and is expected to see demand continue to diminish gradually as the capabilities of other types of mass spectrometers continue to improve, enabling more and more applications to be transferred away from magnetic sector instruments. Thermo Scientific has consolidated the majority of vendor share in the market, while all of the other competitors in the market, with the exception of Waters, are small niche vendors that do not compete in other areas of the MS market.

The Clinical Market

The clinical analysis market, including both research and diagnostics, has seen very strong growth for more than a decade and has been largely immune to the impact of weaker economic environments and recessions. There has long been considerable interest and attention paid to the potential for MS to become a commonplace tool in the sector, particularly for clinical diagnostics, but thus far the vast majority of demand has remained on the research side of the market. The ability of MS techniques to quantify very low levels of critical biomarkers of diseases makes the technology potentially attractive to the clinical market, as it offers a combination of sensitivity, selectivity, and speed that is often unmatched by currently used techniques. Also, MS can analyze multiple analytes simultaneously. Triple-quadrupole LC–MS has by far become the most common category of MS used in clinical analysis, particularly on the diagnostics side of the market, although MALDI-TOF, QTOF, and FT–MS are also significantly used. The limitations to the use of MS in diagnostics continues to be complexity, sample preparation, and lack of standardization; however, vendors have been working hard to address these issues. Because of these limitations, very few MS systems have yet been able to gain the Food and Drug Administration (FDA) 510(k) approval as medical devices in the US, although many clinical laboratory improvement amendment (CLIA)-certified clinical laboratories, have developed MS-based laboratory developed tests (LDTs) that do not require FDA certification. In Europe and Canada, however, there are now a number of regulatory approved MS-based clinical diagnostic tests. Over the last several years vendors have been putting increased resources into gaining regulatory approval for their MS solutions in all regions, as well as partnering with major clinical testing laboratories to help them develop their own tests. The most obvious part of this effort on the part of MS vendors has been the acquisition of leading vendors in the clinical diagnostics market. PerkinElmer was one of the first with its 2006 acquisition of NTDLabs, which focuses on prenatal screening, and helped PerkinElmer develop LC–MS-MS-based neonatal screening solutions that were among the first regulatory approved MS-based clinical testing solutions. In 2011, Danaher acquired Beckman Coulter, which was grouped into the company's Life Science and Diagnostics division alongside what is now AB Sciex. In 2012, Danaher acquired IRIS International, which specializes in urinalysis, and combined it with the Beckman Coulter Diagnostics group. Also taking place in 2012 were the acquisitions of One Lambda by Thermo Scientific, and Dako by Agilent, which accounted for more than $500 million in diagnostics revenues in 2012. Thus far, the clinical market, including both research and diagnostics, accounts for about 6% of the total MS market, but that percentage will grow significantly over the next several years.

Government Demand

There has recently been a heavy focus on the potential impact to various industries by cutbacks and uncertainty in government spending, and the MS market is certainly no exception in this regard. Whether it is austerity in Europe, the sequester in the US, or cutbacks elsewhere, it is undeniable that overall demand for MS from government laboratories and laboratories that receive significant government funding are likely to take at least a small hit in demand in 2013. It is not only directly funded government research and regulatory testing laboratories that are affected, but so too are many academic research laboratories whose projects are government funded. Contract environmental testing laboratories are also likely to see an impact, as all levels of government, from federal to local, are facing difficult times and are likely to cut back the volume of water and environmental samples sent out for testing, when possible. Such impacts could already be clearly felt in late 2012, as government and related demand for initial systems, particularly for higher ticket models, was flat or declined slightly as end-users delayed large capital investments. However, most of these laboratories continued to perform their activities, thereby leading to slight growth in aftermarket and service demand. The major MS vendors are none too optimistic that this situation will reverse itself significantly before the end of 2013.

The Competitive Landscape

Although the major vendors and their overall vendor shares have remained fairly consistent over the past half-decade, the competitive landscape has shifted considerably. The complexity involved in designing, manufacturing, marketing, and supporting mass spectrometers provide for very high barriers to entry; therefore, vendor share has always been relatively concentrated. The top four vendors, consisting of AB Sciex, Agilent, Thermo Scientific, and Waters, have remained the same throughout this time, and have consistently accounted for about two-thirds of the overall vendor share, combined, although Agilent has gradually improved its vendor share. Bruker, Shimadzu, and PerkinElmer are also considered major MS system vendors and have steadily improved their overall positions in the market in recent years. Of course, the one notable name that has vanished is Varian, with most of its MS business being broken up between Agilent and Bruker. During this period, the somewhat convoluted arrangement between MDS SCIEX, Applied Biosystems, and PerkinElmer was reshuffled into much more simplified businesses, with the vast majority of the operation now part of AB Sciex, which is owned by Danaher, and the ICP-MS operation now fully controlled by PerkinElmer. These top seven companies now account for well over 80% of the entire MS vendor share.

Stuart M. Press is the Vice President Strategic Analysis at Strategic Directions International, Inc. in Los Angeles, California. Direct correspondence to: spress@strategic-directions.com

Characterizing Plant Polysaccharides Using Size-Exclusion Chromatography

April 4th 2025With green chemistry becoming more standardized, Leena Pitkänen of Aalto University analyzed how useful size-exclusion chromatography (SEC) and asymmetric flow field-flow fractionation (AF4) could be in characterizing plant polysaccharides.

Investigating the Protective Effects of Frankincense Oil on Wound Healing with GC–MS

April 2nd 2025Frankincense essential oil is known for its anti-inflammatory, antioxidant, and therapeutic properties. A recent study investigated the protective effects of the oil in an excision wound model in rats, focusing on oxidative stress reduction, inflammatory cytokine modulation, and caspase-3 regulation; chemical composition of the oil was analyzed using gas chromatography–mass spectrometry (GC–MS).