Market Profile: Water Analysis

The environmental market peaked about fifteen years ago when the United States government passed a large body of new environmental laws and strengthened existing ones, dramatically increasing the number of mandated tests. As a result, the analytical instruments market received a boost in new instrument sales. While growth from the environmental market has slowed considerably since, the total market is still quite significant.

The environmental market peaked about fifteen years ago when the United States government passed a large body of new environmental laws and strengthened existing ones, dramatically increasing the number of mandated tests. As a result, the analytical instruments market received a boost in new instrument sales. While growth from the environmental market has slowed considerably since, the total market is still quite significant.

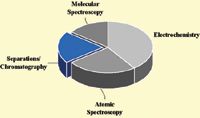

Laboratory water analysis demand by technology.

One application fueling growth in the environmental sector is water analysis.

Water testing covers a broad spectrum of applications including industrial process water, potable and drinking water, wastewater, surface and groundwater, industrial effluent, and power or cooling water. These applications are driven heavily by government regulations. In fact, the European Water Framework Directive of 2000, in addition to other existing legislation, is driving efforts to protect water quality.

Developing regions like China and the Pacific Rim are experiencing explosive growth due to the widespread implementation of water quality regulations, much of which mirrors regulations in industrialized nations. Drinking water has long been a major problem in countries like China and India, where populations are large and dense, but the available supply of fresh water is shrinking. The Chinese government intends to spend $175 billion on environmental protection over the next 10 years.

There are relatively few instrument technologies used for water analysis. Electrochemistry techniques like pH, ion selective electrodes, conductivity, dissolved oxygen, and titration, are perhaps the instrument techniques most used. Other instrumentation includes atomic spectroscopy techniques, molecular spectroscopy, and separations techniques like HPLC, IC, GC, and GC–MS. Overall, chromatography techniques account for about 20% of the total laboratory market for water analysis.

The foregoing data was extracted and adapted from Instrument Business Outlook, an SDi publication, and SDi's Global Assessment Report, 9th Edition. For more information, contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, e-mail: cudiamat@strategic-directions.com

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Polysorbate Quantification and Degradation Analysis via LC and Charged Aerosol Detection

April 9th 2025Scientists from ThermoFisher Scientific published a review article in the Journal of Chromatography A that provided an overview of HPLC analysis using charged aerosol detection can help with polysorbate quantification.