Market Profile: Process chromatography

LCGC North America

Process chromatographs, in particular process gas chromatographs (GCs), is a well-established technique within the oil and gas, refining, and petrochemical industry.

Process chromatographs, in particular process gas chromatographs (GCs), is a well-established technique within the oil and gas, refining, and petrochemical industry. The technique is generally used in process plants to determine product quality and yield. Like most process analytical instruments, its primary role is to monitor conditions at critical points in the overall process. The investment for process GCs is typically justified by inherently providing data that would lead to an increase in a product’s yield.

There are three distinct categories of process chromatographs. Process GCs are traditional PGCs for rigorous process applications. Process GCs also include special-purpose (often rack-mounted) PGCs used for selected applications such as monitoring volatile organics, or VOCs, in environmental monitoring and occupational safety and health. British thermal unit (BTU) systems are dedicated porous graphic carbons (PGCs) used to measure BTU or calorific value of natural gas. The final category is process liquid chromatographs(LCs), which include high-pressure liquid chromatographs (HPLCs) and ion chromatography (IC) instruments used for process analytics.

With trends toward digital solutions and the Internet of Things (IoT), plants are learning more about their processes and instruments that are increasing overall performance and reducing operating costs. New plants are installing modern process GCs that more than just increase product’s yield, but also can play an important role in the overall plant operation themes such as preventing unscheduled downtimes, remote monitoring, and system diagnostics.

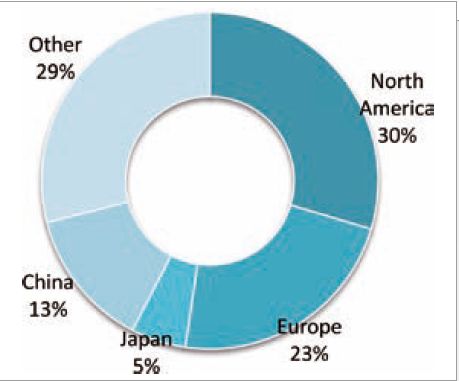

The total demand for process chromatographs was measured at more than $200 million in 2017, including instruments, parts and consumables, and service. Service continues to play a significant role in the market and is expected to outpace instrument sales. North America and Europe account for about half of the market fueled by robust demand for BTU analyzers. North American and (Western) European markets will be characterized by ongoing replacement and upgrade sales to change outdated units in the installed base that do not include the most current communication and diagnostic functions, or that are obsolete and no longer supported by the supplier. Leading suppliers of process chromatographs include ABB, Emerson, Siemens, and Yokogawa.

Demand by region for process chromatography in 2017.

Market size and growth estimates were adopted from TDA’s Industry Data, a database of technology market profiles and benchmarks, as well as the 2018 Instrument Industry Outlook report from independent market research firm Top-Down Analytics. For more information, contact Glenn Cudiamat, general manager, at (888) 953-5655 or glenn.cudiamat@tdaresearch.com. Glenn is a market research expert who has been covering the analytical instrumentation industry for more than two decades.

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)