Market Profile: Pharmaceutical Market Demand for Life Science Instrumentation

Globally, 2005 sales of pharmaceuticals have been estimated at approximately $550 billion. A significant fraction of this amount was due to the top pharmaceutical companies in the world. The top five companies alone were responsible for total revenues of $168 billion, or 30% of the entire market.

Globally, 2005 sales of pharmaceuticals have been estimated at approximately $550 billion. A significant fraction of this amount was due to the top pharmaceutical companies in the world. The top five companies alone were responsible for total revenues of $168 billion, or 30% of the entire market. Expanding the situation to the top twenty pharmaceutical companies, the share increases to well over 50%.

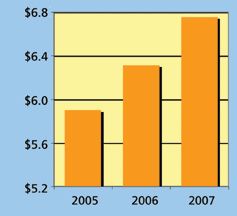

The research and development budgets of these companies shows that most of the top firms have R&D budgets that represent 15-30% of their total revenue. The average is somewhat over 20%. This equates to a global R&D budget on the order of $100 billion. Of course, instrumentation is by no means the largest portion of this total budget. In fact, SDi estimates that nearly $5.9 billion was spent on analytical and life science instrumentation in 2005. Not surprisingly, the pharmaceutical industry tends to invest its money on technologies like liquid chromatography, mass spectrometry, automated techniques, and informatics. Overall, the pharmaceutical market for analytical instrumentation is expected to increase 6-8% over the next few years.

Pharmaceutical demand for analysis and life science instrumentation.

Despite this enormous sum being spent on research and development, one current crisis in the pharmaceutical industry is the paucity of drugs successfully making it to the market. Although the FDA was approving 80-90 drugs per year in the late 1990s and early 2000s, this number has dwindled rapidly. In 2005, the FDA approved a record low 15 new drug therapies. The number of new chemical entities (NCEs) being approved also has dropped in a similar fashion. This pipeline problem might be reaching critical severity for the pharmaceutical industry and new technological tactics might well be required to solve the problem.

The foregoing data was extracted from Strategic Directions International, Inc. Market Analysis and Perspectives (MAP) report entitled, "Life Science Instrumentation: Supporting Systems Biology in Integrating Genomics, Proteomics, and Drug Discovery." For more information, contact Glenn Cudiamat, Vice President of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045; tel. (310) 641-4982, fax (310) 641-8851.

cudiamat@strategic-directions.comhttp://www.strategic-directions.com~

Common Challenges in Nitrosamine Analysis: An LCGC International Peer Exchange

April 15th 2025A recent roundtable discussion featuring Aloka Srinivasan of Raaha, Mayank Bhanti of the United States Pharmacopeia (USP), and Amber Burch of Purisys discussed the challenges surrounding nitrosamine analysis in pharmaceuticals.

Extracting Estrogenic Hormones Using Rotating Disk and Modified Clays

April 14th 2025University of Caldas and University of Chile researchers extracted estrogenic hormones from wastewater samples using rotating disk sorption extraction. After extraction, the concentrated analytes were measured using liquid chromatography coupled with photodiode array detection (HPLC-PDA).