Market Profile: Chinese Chromatography Market

China has experienced explosive growth over the past decade, and it has been a boon to the analytical instrumentation industry.

China has experienced explosive growth over the past decade, and it has been a boon to the analytical instrumentation industry. Demand for mainstream separation technologies such as liquid chromatography, ion chromatography (IC), and gas chromatography (GC) continues to expand in the country.

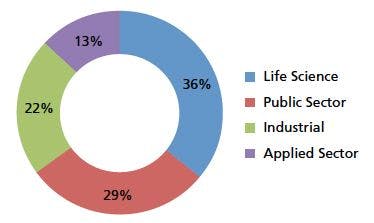

Chromatography demand in China by application sector.

Life science industries (such as pharmaceutical, biopharma and biotech, and contract research organizations) represent the largest sector for separation technologies, accounting for more than a third of the market in China, fueled by demand for ultrahigh-pressure liquid chromatography (UHPLC) and high performance liquid chromatography (HPLC) instruments. While the market for life science applications continues to increase, the growth from environmental, agriculture, and food and beverage applications has been exceptional during the last year, driven by enforcement of regulations in the country. This has resulted in strong growth for GC and IC instruments. The applied sector is estimated to account for approximately 13% of the market in 2015. The public sector, including academia and government laboratories, remains a key segment in China. Unlike the U.S. and European public sectors, which are expected to contract in the near-term, China’s public sector is forecasted to post double-digit growth over the next five years in the United States and Europe due to continued investment into research. Not all sectors have been hale and hearty in China, however. Like the United States and Europe, China has been impacted by the global uncertainties and macroeconomic forces in the chemical and energy markets. Overall, the industrial sector accounted for about 22% of the market. Major system manufacturers including Agilent, Shimadzu, Thermo Scientific, and Waters have a stronghold over the Chinese market and have benefited greatly from the torrid expansion in China. In fact, many of the manufacturers reported that China represents the second largest country for instrument sales, after the United States. Overall, the market for chromatography instruments in China accounted for nearly $5 billion dollars and is expected to expand to double digits over the next few years. Moreover, demand for consumables and service is expected to ramp up quickly over the next few years, adding more fuel to an already hot market. This market information was extracted from new data and analysis from the independent market research firm Top-Down Analytics. For more information, contact Glenn Cudiamat, General Manager, at (888) 953-5655 or glenn.cudiamat@tdaresearch.com. Glenn is a market research expert and has been covering the analytical instrumentation industry for nearly two decades.

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.