Laboratory Information Management Systems

Today's laboratories are sophisticated, generate large amounts of data, and rely on electronic data collection and tracking via a laboratory information management system (LIMS).

Today's laboratories are sophisticated, generate large amounts of data, and rely on electronic data collection and tracking via a laboratory information management system (LIMS).

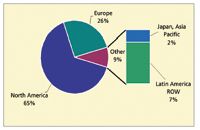

Reginal distribution of LIMS survey respondents.

A LIMS allows a laboratory to manage both logistic and analytical data, along with having the ability to interface with corporate reporting software, instruments, and a host of other software modules. The LIMS has become a necessity for both small and large companies to allow its users to obtain, store, manage, retrieve, and report laboratory data. LIMS products in the market vary widely in cost, sophistication, and industrial focus.

Companies can opt to design a LIMS to suit their exact needs with respect to their internal processes, instruments, and general operation from the ground up. However, this all comes at a premium. Instead, many companies are abandoning LIMS developed in-house developed LIMS for commercial systems.

While vendors offer generic LIMS packages that can be customized for any lab, LIMS vendors also are offering "off-the-shelf" solutions, which address vertical markets by integrating more functionality into the core software. Because off-the-shelf products are designed for a particular industry, lab function, and application, users do not need to spend as much time customizing the LIMS. This means users can begin to utilize the LIMS quicker.

In a recent survey from Strategic Directions International, over 650 LIMS users were asked to indicate the top criteria when choosing a LIMS vendor. The most frequently mentioned criteria were customer and technical support, reputation, and a company's long-term stability. These criteria have become increasingly important over the years, partly because of the magnitude of LIMS installations and the vital role it plays in everyday laboratory decisions.

The accompanying graph shows the regional distribution of respondents to the survey. North America represented the largest segment of respondents. Europe and Japan/Asia Pacific combined for 28% of the respondents, while Latin America and the rest-of-world accounted for 7%.

The foregoing data was extracted from SDi's Tactical Sales and Marketing (TSM) report entitled: Labs on LIMS 2007. Contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045; tel. (310) 641-4982, fax (310) 641-8851, e-mail: cudiamat@strategic-directions.com

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.