Market Profile: Solid-Phase Extraction

Solid-phase extraction (SPE) has been commercially available for nearly 25 years and is still finding new applications.

Solid-phase extraction (SPE) has been commercially available for nearly 25 years and is still finding new applications. Growth of this technique seems to be largely a function of the vendors’ capability to provide specific application support, especially in clinical sciences, pharmaceuticals, toxicology, pesticides, and residues analysis.

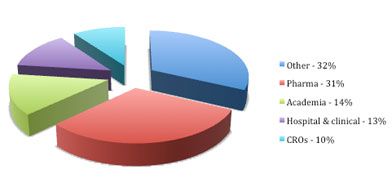

2012 SPE demand by industry

The market can be segmented into three product types: automated systems, nonautomated systems, and related aftermarket products. Nonautomated systems are assemblies of hardware products that are used in combination with SPE columns, plates and disks. These products include vacuum pumps, manifolds, and evaporation systems, which require little if any maintenance and are easy to operate and set up. Because of the relatively low cost, they are used primarily in laboratories with low throughput requirements that therefore cannot justify the purchase of an automated system.

Automated systems are somewhat expensive, ranging from $25,000 to $100,000, but are perhaps the most practical solution when preparing a large number of samples. Many automated SPE systems are liquid handling stations, which are often used to satisfy the high throughput requirements of combinatorial chemistry, drug discovery, and development laboratories. Other automated SPE systems have the ability to directly inject purified and concentrated samples into a high performance liquid chromatography (HPLC), gas chromatography (GC), mass spectrometry (MS), or nuclear magnetic resonance (NMR) system for on-line SPE automation.

SPE, however, is most often performed manually. In most cases, its ease of use, inexpensiveness, and disposability make manually operated SPE cartridges, disks, and plates preferable to automated systems. Cartridges are the most popular format, having a broader selection of solid phases than disks and plates. Disks are slightly more expensive than cartridges, but they offer the ability to accommodate higher flow rates, which is advantageous in many environmental applications.

The pharmaceutical industry accounted for the largest industrial demand for SPE, with a 2012 market share of nearly one third. Academia, hospital/clinical laboratories, and CRO laboratories followed with 14%, 13%, and 10%, respectively. Biotechnology, general/environmental testing, government testing/research, and agriculture/food and beverage are also significant markets for SPE.

The foregoing data were extracted and adapted from SDi's recently published report titled Laboratory Sample Preparation Techniques: Breaking the Productivity Bottleneck - Prep Chromatography, Extraction & Concentration. For more information, contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, email: cudiamat@strategic-directions.com

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)