The Analytical and Life Science Instruments Industry

The last few years have been particularly eventful for instrument companies as the prior prospects were hampered by the global recession, which affected some of the analytical and life science instrument sectors more than the others.

The last few years have been particularly eventful for instrument companies as the prior prospects were hampered by the global recession, which affected some of the analytical and life science instrument sectors more than the others. Nevertheless, the overall market is on its path to recovery driven by continued business collaborations, acquisitions, new product innovations, and other key variables playing a positive role on the global analytical and life science instrumentation market. Regions such as China and Asia-Pacific are expected to be the forefront of growth and prosperity.

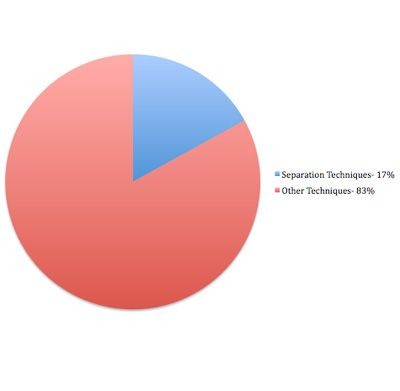

2009 analytical and life science instrumentation demand.

The global market for analytical instrumentation increased from $30 billion in 2004 to more than $37 billion in 2009. The analytical and life science instrumentation market encompasses ten categories, which include separations, life science instrumentation, mass spectrometry, molecular spectroscopy, atomic spectroscopy, surface science techniques, materials characterization, laboratory automation, general analytical techniques, and select lab equipment. These ten categories are further divided into 74 individual technology sections giving a complete market analysis and overview of the market trends from a regional, industrial, functional, and competitive standpoint.

Although 2009 was rather challenging, the global analytical and life science instruments industry has started its recovery. The separations market, in particular, which includes HPLC, gas chromatography, ion chromatography, low pressure liquid chromatography, flash chromatography, and chemicals sensors, accounts for 17% of the global $37 billion market and is expected to grow mid-single digits for the next five years. The demand from initial system sales, particularly to pharmaceutical and life science research are expected to drive the market. Growth from chemicals/petrochemicals and biofuel research initiatives, as well as environmental regulations, are also positively impacting the separations market.

The foregoing data was extracted from SDi’s Global Assessment Report, 11th Edition. For more information, contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, tel. (310) 641-4982, fax (310) 641-8851, e-mail:cudiamat@strategic-directions.com

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.