Separations Market in India

Although the Indian economy has garnered world attention with its importance in the information technology and service sectors, the country has recently become far more prominent in industries that are strong sources of demand for analytical instrumentation.

Although the Indian economy has garnered world attention with its importance in the information technology and service sectors, the country has recently become far more prominent in industries that are strong sources of demand for analytical instrumentation. Foremost among these are country’s life science industries including pharmaceuticals, biotechnology, contract research organizations, and the public sector comprising academia and government.

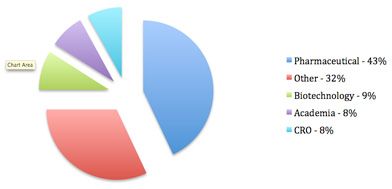

Separations demand in India by industry for 2011

The pharmaceutical and biotechnology sector provides big growth opportunities in terms of industrial segmentation. Domestic pharmaceutical and generic drug manufacturers continue to increase their output, spurring growth in both R&D and quality control applications for analytical instrumentation. Global drug manufacturers are also increasing their investment in the country, although concerns remain about patent protection in the country.

Contract research organizations (CROs) also benefit from this growth and are actively expanding operations. India has been the primary destination for outsourcing clinical trials for the pharmaceutical industry, and this has helped to promote and expand the CRO market alongside the growth of pharma and biotechnology in the country.

In the public sector, India has recently entered the top 10 countries for scientific publications. Although R&D spending in industry is relatively modest in India, the government supports a wide variety of scientific endeavors in its universities and government laboratories. The Indian government is concerned about falling behind China in terms of R&D and continues to push for an expansion in public funding for research.

By a large margin, pharmaceutical applications are the most prominent for separations technology in India, making up 43% of the total demand in 2011. Although the biotechnology and CRO industries are significantly smaller, accounting for 9% and 8% of the Indian separations market, respectively, they are among the fastest growing. The academic industry clinches the fourth spot in India’s separations market with 8% of the 2011 market share.

The foregoing data were extracted and adapted from SDi’s Market Analysis and Perspective report entitled Roadmap to Nirvana: The Indian Market For Analytical Instrumentation. For more information, contact Glenn Cudiamat, VP of Research Services, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, e-mail: cudiamat@strategic-directions.com

Regulatory Deadlines and Supply Chain Challenges Take Center Stage in Nitrosamine Discussion

April 10th 2025During an LCGC International peer exchange, Aloka Srinivasan, Mayank Bhanti, and Amber Burch discussed the regulatory deadlines and supply chain challenges that come with nitrosamine analysis.

Top Execs from Agilent, Waters, and Bruker Take the Stage at J.P. Morgan Healthcare Conference

January 16th 2025The 43rd Annual Healthcare J.P. Morgan Healthcare Conference kicked off in San Francisco earlier this week. Here’s what top executives from Agilent, Bruker, and Waters, discussed during the event.

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)

.png&w=3840&q=75)